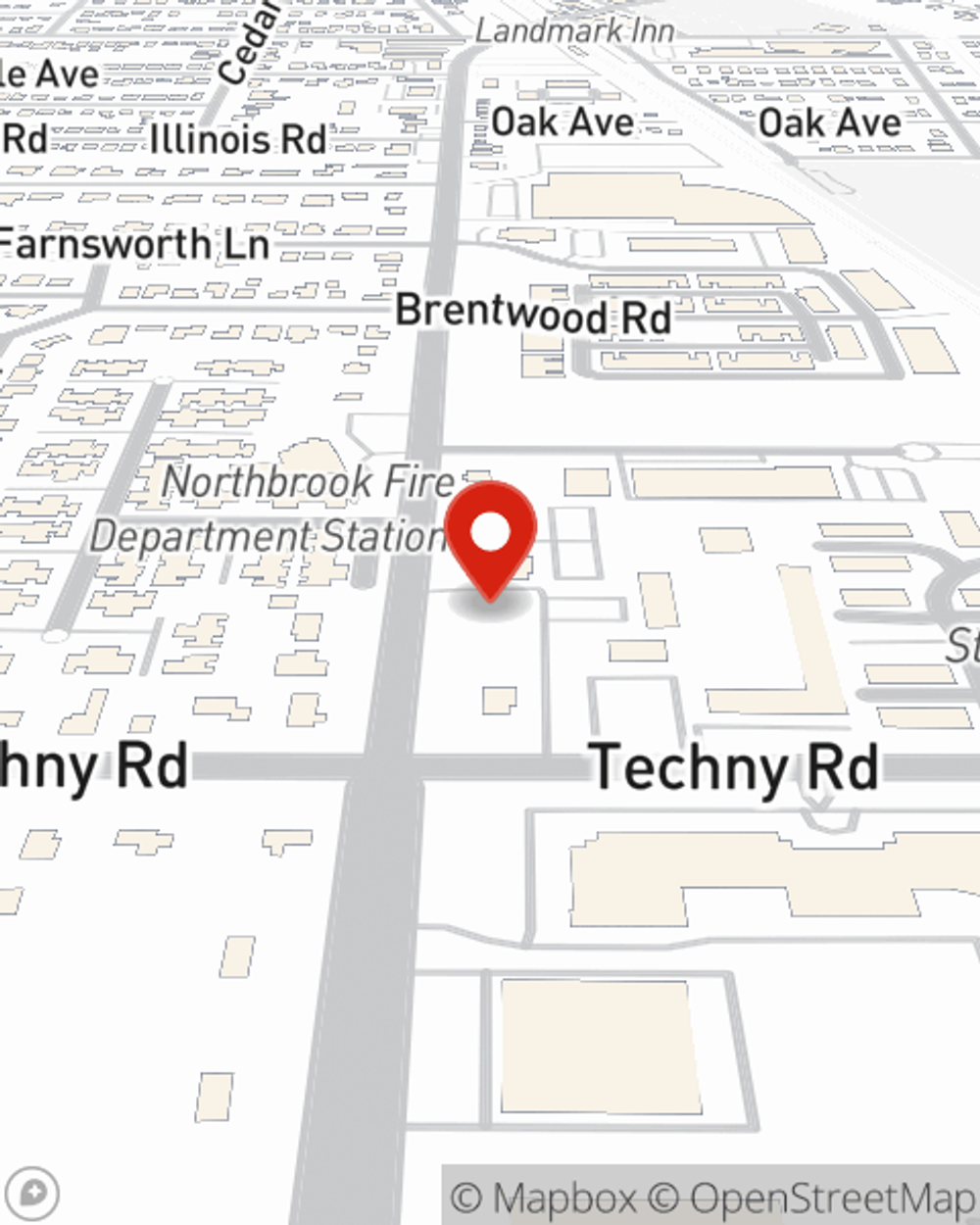

Business Insurance in and around Northbrook

Northbrook! Look no further for small business insurance.

Almost 100 years of helping small businesses

- Northbrook, IL

- Glenview, IL

- Deerfield, IL

- Il, US

This Coverage Is Worth It.

Small business owners like you have a lot of responsibility. From customer service rep to marketing guru, you do whatever is needed each day to make your business a success. Are you an insurance agent, a home cleaning service or an optometrist? Do you own a hobby shop, a dry cleaner or an antique store? Whatever you do, State Farm may have small business insurance to cover it.

Northbrook! Look no further for small business insurance.

Almost 100 years of helping small businesses

Surprisingly Great Insurance

When one is as enthusiastic about their small business as you are, it is understandable to want to make sure everything is in order. That's why State Farm has coverage options for commercial liability umbrella policies, business owners policies, worker’s compensation, and more.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Matt Bauer's team to discover the options specifically available to you!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Matt Bauer

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.